Completing Financial Aid Requirements

Questions? Contact Us.

DMACC

Financial Aid Office

finaid@dmacc.edu

515-964-6282

How to Complete Your Financial Aid Requirements

Step 1

Go to www.dmacc.edu and click on myDMACC.

Step 2

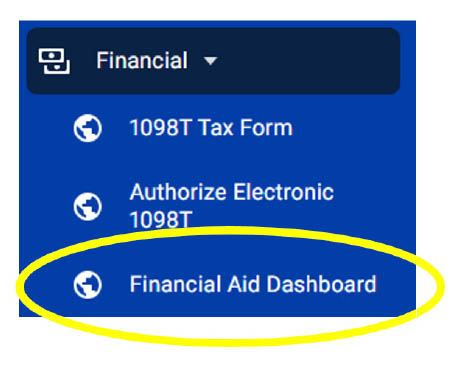

After you have signed into myDMACC, navigate to the Tools Menu. Click on Financial. Click on Financial Aid Dashboard.

Step 3

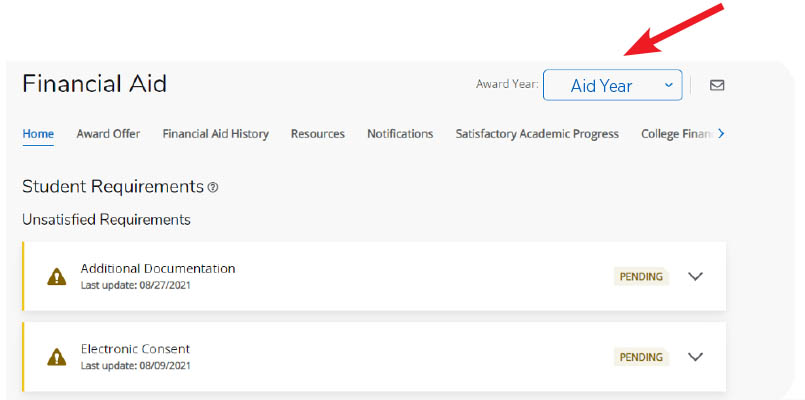

After reaching the Home page, select the appropriate Aid Year from the drop down menu.

Step 4

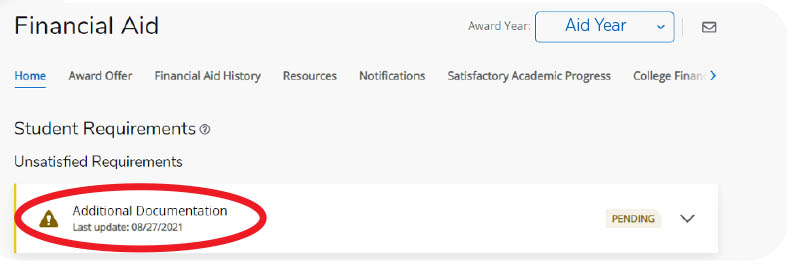

If you have the Additional Documentation requirement, you will have to complete the following steps.

Step 5

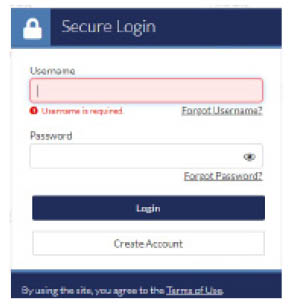

Click on the link in the Additional Documentation requirement and sign in using your DMACC e-mail address (including the “@dmacc.edu”) and your password.

If this is the first time you've accessed this page, you will be asked to confirm

your name, date of birth and social security number. These items must match what you

reported on

your FAFSA.

Step 6

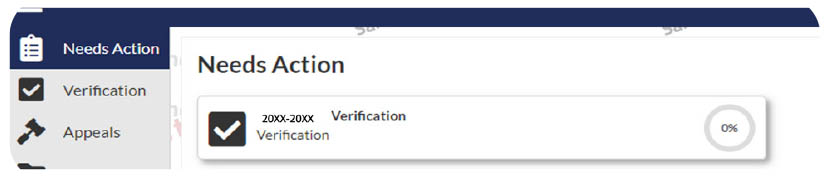

Click on the tile that needs action.

Step 7

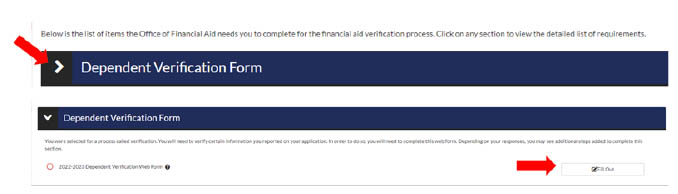

Click on the arrow to expand the task. Click the Fill Out button to complete the form.

Step 8

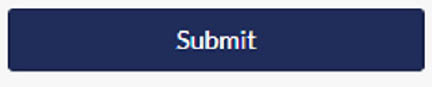

When you have completed all tasks and submitted all requested documents, click the Blue Submit button.

Step 9

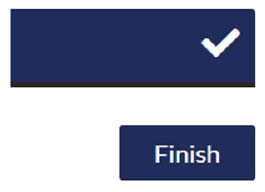

After all tasks have been completed, click the blue Finish button.

Verification

Verification is the process of reviewing a student’s FAFSA for accuracy. If you are selected for verification, you will be asked to provide additional information. The Financial Aid Office will help you through this process by identifying what forms you need to complete, or what documents you need to provide. You will be notified on your DMACC email and be asked to login to the online document portal to view requirements if you are selected for verification.

IRS Tax Information

The IRS Data Retrieval Tool (IRS DRT) is available to use to import your tax information from the IRS into your FAFSA. The IRS DRT remains the fastest, most accurate way to input your tax return information into the FAFSA form. You can access the IRS DRT from your FAFSA.

If you are not able to use the IRS DRT you can provide a signed copy of your federal 1040 and supporting tax schedules. Or you can request a Tax Return Transcript free of charge from the IRS in one of four ways.

- Online Request: Go to the IRS website and select "Get Transcript Online". (Be sure to disable pop‐up blockers).

- Mail Request: Go to the IRS website and select "Get Transcript by Mail".

- Paper Request: Download a PDF for the 4506‐T.

- Telephone Request: Call the IRS at 1-800-908-9946

Submitted Electronically to DMACC through Banner Self Service:

- Amended Federal Tax Returns

- Assets Information

- Citizenship Verification (passport, naturalization

papers, I-94, etc.) - Confirmation of Active Duty

- Default Paperwork (documents identifying that your federal student loans are no longer in active default)

- Dependency Override Appeal

- Disability Forms

- Family Contribution Appeal

- GED/High School Transcript/Home School Certificate

- Homeless Documentation

- Household Size Form

- Identity and Statement of Educational Purpose

- Legal Guardianship or Ward of Court Documentation

Marital Status Documentation - Parent Non-Filing Letter from IRS.gov or Non-Filing Form

- Parents’ Signed Federal Tax Return or Tax Return

Transcript (www.irs.gov, Get Your Tax Record) - Parent Unwilling to Provide Information

- Parents’ W2s or Wage and Income Transcript from

IRS.gov - Social Security Card (provide copy of yours or parents’ Social Security card)

- Spouse Non-Filing Letter from IRS.gov or Non-Filing Form

Spouse’s W2s or Wage and Income Transcript from IRS.gov - Student Non-Filing Letter from IRS.gov or Non-Filing Form

- Student Signed Federal Tax Return or Tax Return

Transcript (www.irs.gov, Get Your Tax Record) - Student W2s or Wage and Income Transcript from

IRS.gov - Unusual Enrollment History Review

- Verification Form

Below are additional forms that may have been requested.

These cannot be completed online, but are available as PDF’s on DMACC’s Financial Aid webpage under Financial Aid Forms:

- Bankruptcy Review Form

- Foreign Tax Form, Parent(s)

- Foreign Tax Form, Student/Spouse

- Satisfactory Academic Process Appeal

- Loan Change Form, maximum amount to ask for $______ (this DMACC form may be completed

electronically).

These items are to be completed on the Federal Student Aid website (studentaid.gov):

- Student Signature

- Parent Signature

- Loan Entrance Counseling

- Master Promissory Note

You will need to submit any paper forms or documents to your local campus either in person, via DMACC email, by fax, or by mailing them to:

DMACC Financial Aid Office

2006 S Ankeny Blvd

Ankeny, IA 50023

Fax: 515-965-7124

Email: finaid@dmacc.edu

You must use your DMACC email account when emailing forms to the Financial Aid Office.