Data Retrieval Tool

Questions? Contact Us.

DMACC

Financial Aid Office

finaid@dmacc.edu

515-964-6282

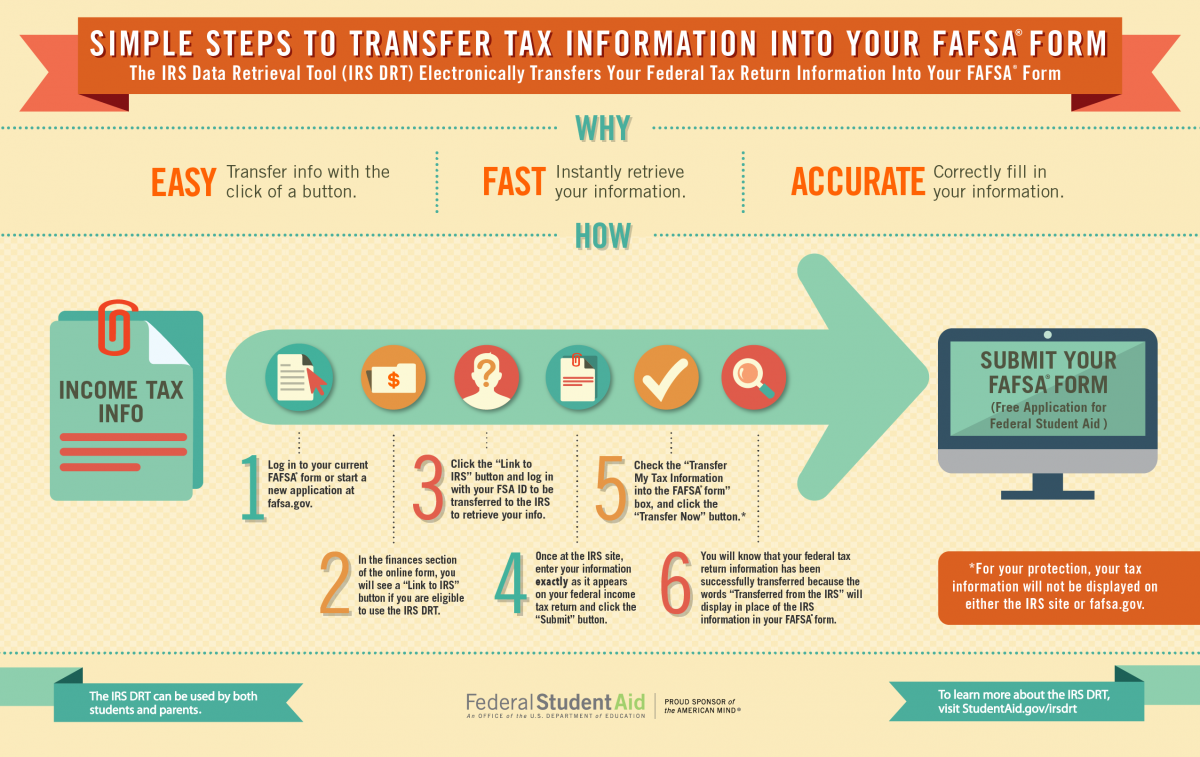

The IRS Data Retrieval Tool allows students to transfer data from their federal income tax returns into their FAFSA electronically.

What is the Data Retrieval Tool?

- IRS Data Retrieval Tool (DRT) process will help simplify the verification process if selected.

- The 2023–24 FAFSA form asks for 2021 tax information.

- The 2022–23 FAFSA form asks for 2020 tax information.

- Using the IRS DRT process can reduce errors on your FAFSA, as well as reduce the amount of requested documents from the Financial Aid Office.

- When you submit the request, the IRS will confirm your identity.

Am I eligible to use the IRS Data Retrieval Tool?

I’m unable to link my tax return. What do I do?

If you are unable to link your taxes to your FAFSA, you may be asked to provide a

copy of your Federal tax Return Transcript. How to get an IRS tax return transcript.

I was selected for verification, but I didn't make enough money to file taxes. What

do I do?

If you did not make enough money to file taxes, then you will need to get a non-filing

letter from the IRS and submit it to the Financial Aid office.