Accepting Your Financial Aid Award

Questions? Contact Us.

DMACC

Financial Aid Office

finaid@dmacc.edu

515-964-6282

How to Accept your Award

Step 1

Go to the DMACC homepage and click on myDMACC.

Step 2

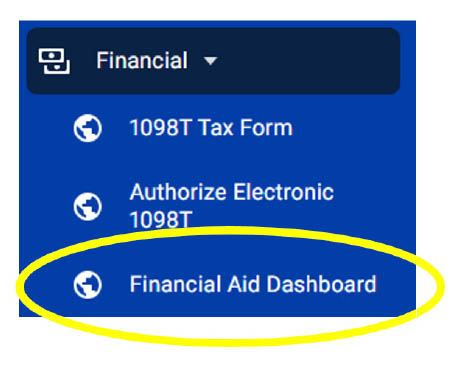

After you have signed into myDMACC, navigate to the Tools Menu. Click on Financial. Click on Financial Aid Dashboard.

Step 3

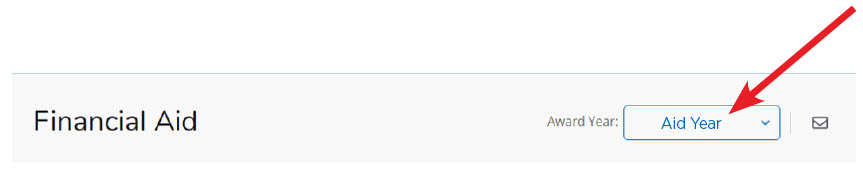

After reaching the Home page, select the appropriate Aid Year from the drop down menu.

Step 4

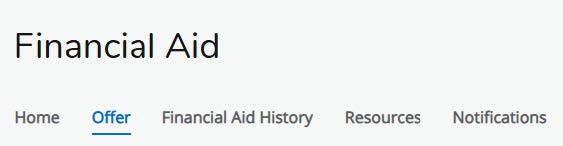

Click on the Offer tab.

Step 5

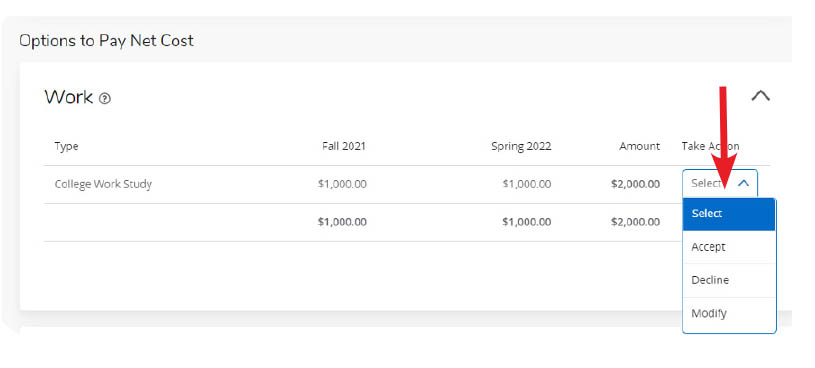

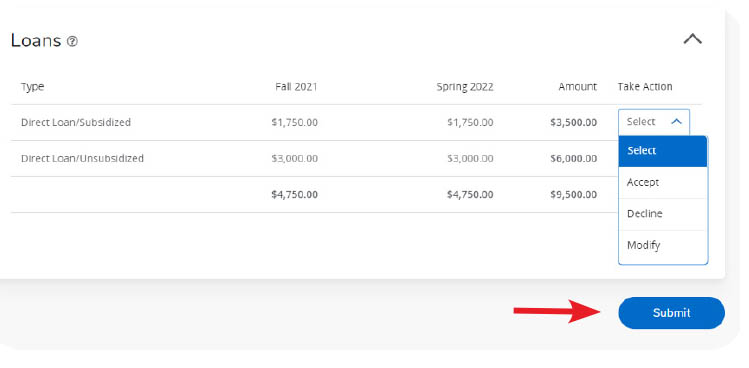

Scroll down to the Options to Pay section and choose to Accept or Decline the College Work Study and/or Student Loans. If you Decline an award, it will be removed from your financial aid offer. If you leave it as Offered, it will be available if you decide to Accept it in the future.

Click Submit when you have made your decision.

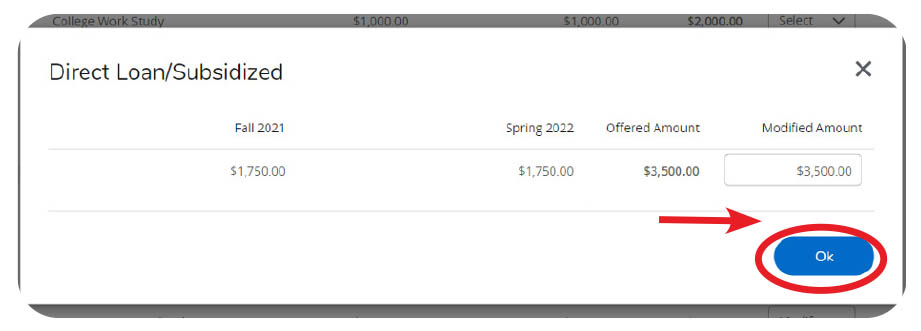

If you wish to change your loan amount(s), click Modify to accept a partial amount. A window will pop up for you to modify the loan amount. Click OK when you have made your changes.

All first-time borrowers must complete an Entrance Counseling and sign a Master Promissory Note (MPN) at STUDENTAID.GOV.

Important Information to Consider

The borrower is responsible for all interest charges, fixed at 6.53%. You can pay the interest quarterly while you are in school or you can opt to defer the interest. If you defer the interest, it will be added to the principal balance of your loan when your loan enters repayment. Interest rates may be updated after July 1, 2025.

Student must be enrolled in an eligible program and registered at least half-time to receive Federal Direct Student Loans (Minimum of 6 credits for Fall & Spring; 4 credits for Summer).

All first-time borrowers must complete Entrance Counseling and sign a Master Promissory Note (MPN) at studentaid.gov.

Freshman status: students who have completed fewer than 32 credits required for an Associate degree program or students enrolled in a certificate or diploma program.

Sophomore status: students who have completed 32 credits or more required for an Associate degree program.

You are considered a dependent student if you were required to submit your parents’ income information on your FAFSA application.